Condo Insurance in and around Downers Grove

Get your Downers Grove condo insured right here!

State Farm can help you with condo insurance

There’s No Place Like Home

As with anything in life, it is a good idea to expect the unexpected and try to prepare accordingly. When owning a condo, the unexpected could look like damage to your most personal possessions from theft vandalism, wind, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Get your Downers Grove condo insured right here!

State Farm can help you with condo insurance

Why Condo Owners In Downers Grove Choose State Farm

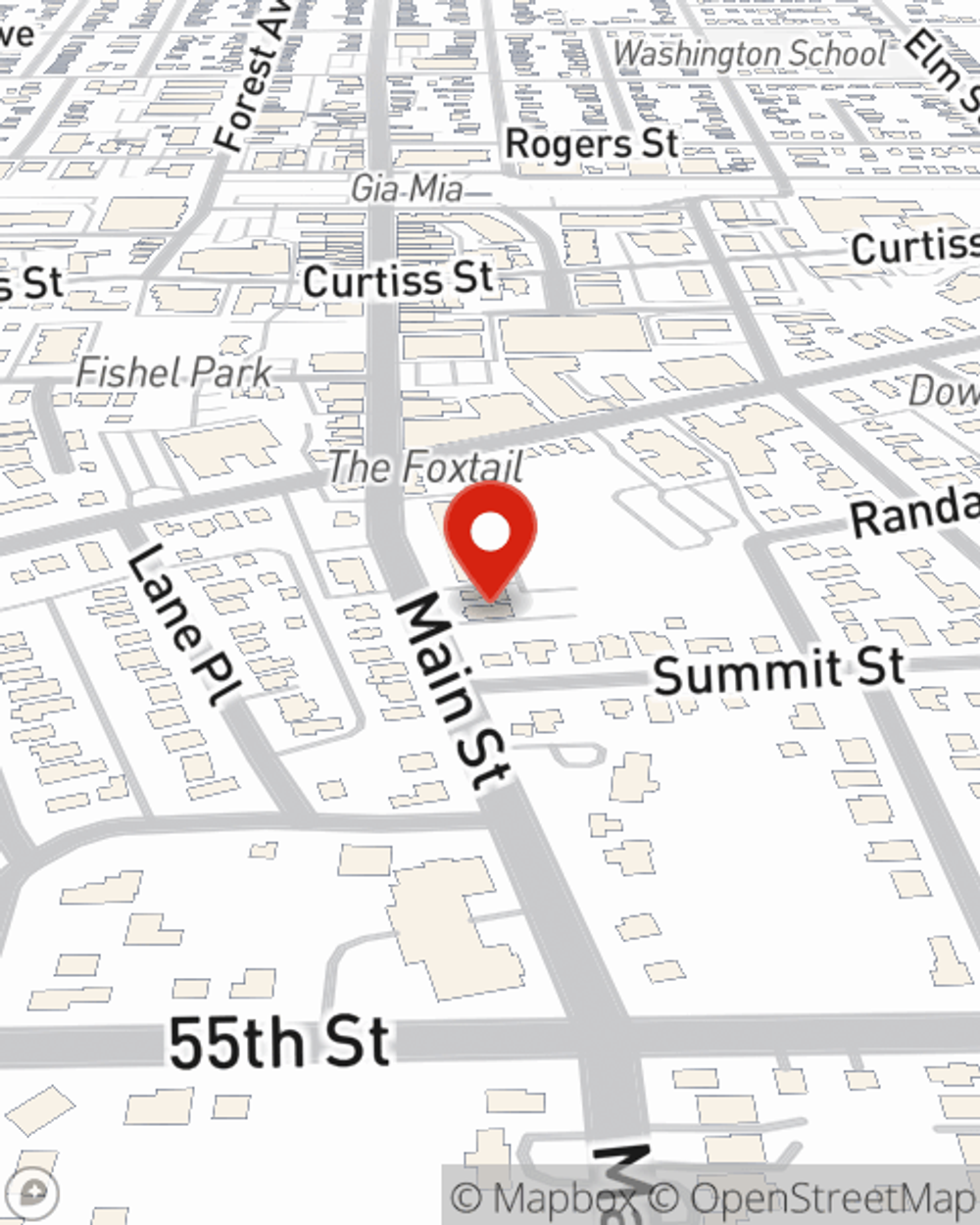

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Andy Herrero is ready to help you handle the unexpected with dependable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Andy Herrero can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Contact agent Andy Herrero today to learn more.

Have More Questions About Condo Unitowners Insurance?

Call Andy at (630) 969-2388 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Andy Herrero

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.